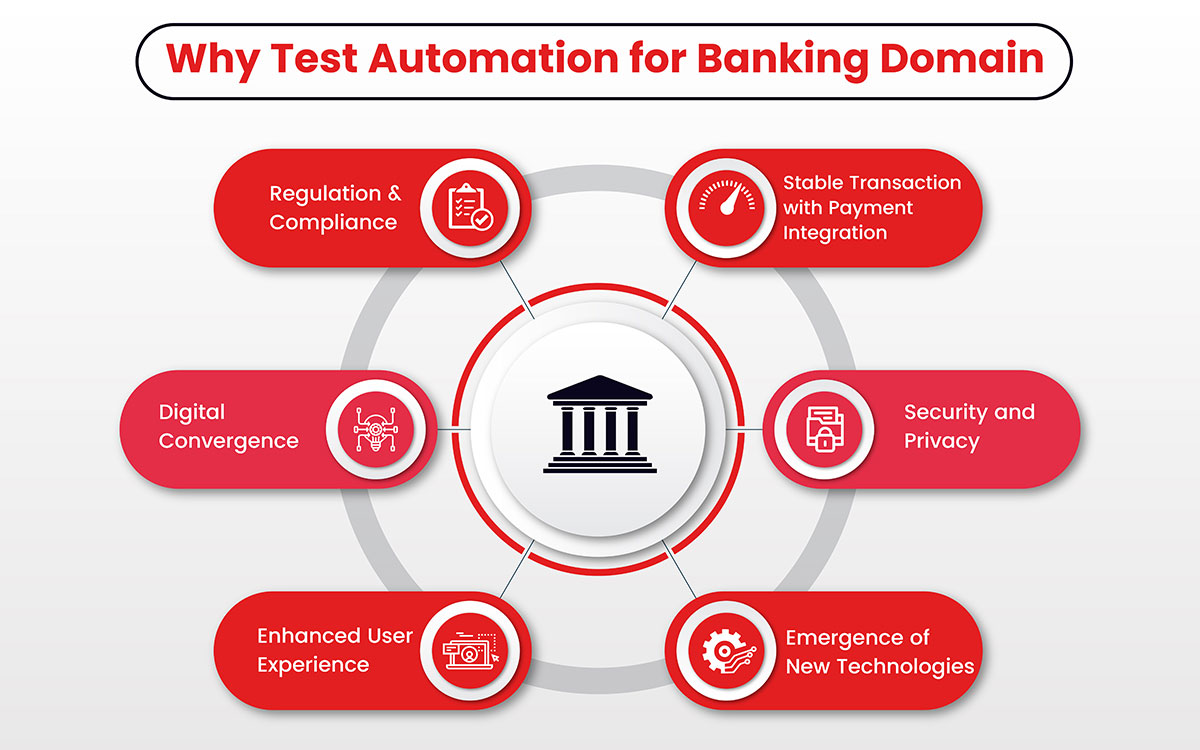

Digital banking has become an increasingly important aspect of financial services as consumers rely on online and mobile banking to manage their finances. As a result, financial institutions must provide a high-quality, seamless experience for their digital banking customers. One way to ensure a positive experience is through test automation.

Test automation refers to automate the testing process of software applications. The intent behind test automation is to speed up the release process while maintaining the high-quality. This includes variety of functional and non-functional testing like unit testing, integration testing, performance testing, and security testing. This helps financial institutions in identifying and fix any issues with their digital banking platforms by automating these tests, improving the overall user experience.

Introduction to the Banking Domain

Banking is a financial service industry responsible for facilitating the transfer of money between individuals, businesses, and organizations. Banks play a central role in the global economy by providing various financial services, including accepting deposits, extending loans, and facilitating payments.

In the banking domain, financial institutions offer a range of services, including:

- Accepting deposits and providing checking and savings accounts

- Issuing credit cards and loans

- Providing foreign exchange services

- Facilitating electronic payments and money transfers

- Offering investment products and financial planning services

Governments regulate banking to ensure the stability and integrity of the financial system. Banks must follow certain rules and regulations, such as maintaining a certain capital level, reducing the risk of failure and protecting customers’ deposits. In recent years, the use of technology in banking has increased with the development of online banking, mobile banking, and other digital financial services.

Characteristics of a banking domain application

A banking application is a software program that allows individuals and businesses to access their financial accounts and perform various banking transactions, such as checking account balances, transferring money, paying bills, and depositing checks. Several characteristics are common to the banking domain:

- Financial transactions: Banking involves the processing of financial transactions, such as deposits, withdrawals, transfers, and payments.

- Regulation: Banks are heavily regulated by government agencies and must comply with strict rules and regulations.

- Risk management: Banks must manage risk in their operations, including credit risk, liquidity risk, and market risk.

- Customer service: Banks must provide good customer service and support, including answering customer questions and addressing their needs and concerns.

- Security: Banks must ensure the security of their systems and protect their customers’ sensitive financial information.

- Innovation: Banks must stay up-to-date with the latest technologies and industry trends to remain competitive.

- Transparency: Banks must be transparent in their operations and disclose information about their products and services to customers.

- Ethics: Banks are expected to operate ethically and in the best interests of their customers.

Is Automated Testing a solution for Banking Domain?

Automated testing can be a useful solution for the banking domain, as it can help to improve the efficiency and accuracy of software development processes. Automated testing involves the use of software tools to automate the execution of test cases, allowing for the testing of a large number of scenarios in a short period of time. This can be particularly useful in the banking domain, where many different processes and systems need to be tested, and where the consequences of errors or bugs can be severe.

Automation testing can be used to test a wide range of banking-related processes and systems, including online banking systems, mobile banking apps, and back-end systems for processing transactions and managing customer data. Automation testing can also be used to test the security of banking systems, helping to identify vulnerabilities and ensure that systems are adequately protected against potential threats.

There are a number of benefits to using automated ion testing in the banking domain, including:

- Improved efficiency and speed: Automated testing allow financial institutions to quickly and efficiently test their digital banking platforms, which can save time and resources compared to manual testing. This can help ensure that issues are identified and addressed in a timely manner and early in the software development lifecycle, improving the overall user experience.

- Increased accuracy and consistency: Automated testing can help in ensuring that testing is performed consistently and accurately, as the test scripts are not subject to human error. This can help reduce the risk of issues being missed or misidentified.

- Enhanced security: Automated testing can help financial institutions to identify and address potential security vulnerabilities in their digital banking platforms. This is important as cyber-attacks and data breaches are a major concern for the banking industry.

- Greater coverage: Automation testing can cover a wider range of scenarios and test cases compared to manual testing, helping to identify issues that may not have been uncovered through manual testing alone.

By implementing automated testing in their digital banking platforms, financial institutions can improve the overall user experience, enhance security, and reduce the risk of missed or misidentified issues.

Know more about How to do Automated Testing for BFSI applications

Challenges and solutions of automation testing for banking domain

Automated testing can be a useful tool for improving the efficiency and effectiveness of testing in the banking domain, but it also comes with a number of challenges. Here are some potential challenges and solutions for automated testing in the banking domain:

- Complex business processes: The banking domain involves complex business processes with many interdependencies and rules. It can be difficult to automate testing for these processes, as it requires a deep understanding of the underlying systems and a robust test design. One solution is to use domain experts to help design the test cases and ensure that they accurately reflect the real-world scenarios being tested.

- Large and constantly evolving systems: Banking systems are often large and constantly evolving, with new features and functionality being added regularly. This can make it difficult to keep up with changes and ensure that the automation test suite is always up to date. One solution is to use a test automation framework that is flexible and easy to maintain, such as one that allows for the easy creation and modification of test cases. Often, in-house development teams are caught with innovation and other important tasks and regular test cases maintenance are missed out. Banking and financial institutions must consider working with the quality engineering experts who deliver outcome-based results.

- Security concerns: The banking domain involves sensitive financial information and transactions, so it is important to ensure that the automation test suite does not compromise security. One solution is to use a testing approach that emphasizes security testing, such as fuzz testing or penetration testing, to identify and address any potential vulnerabilities.

- Integration with legacy systems: Many banking systems have legacy components that may not be easily integrated with newer automation testing tools. The solution is to use an automated testing tool that is compatible with a wide range of technologies and platforms, or to use an integration platform that can bridge the gap between different systems. Assessing automated testing tools can be overwhelming. Talk to us at info@enhops.com to know which tool can fulfill your requirements.

- Managing test data: Testing in the banking domain often requires the use of large amounts of data, including sensitive financial information. Managing this data can be challenging, as it is important to ensure that the data is secure and that the test cases represent real-world scenarios. One solution is to use a test data management tool that can help create and manage test data securely and efficiently.

Enhance digital confidence of your banking application with our end-to-end test automation service

Here are some potential solutions for addressing the challenges of automation testing in the banking domain:

- Use domain experts to help design test cases: Bringing in experts who have a deep understanding of the banking domain can help ensure that the test cases accurately reflect real-world scenarios and cover all relevant business processes and rules.

- Use a flexible and maintainable test automation framework: A test automation framework that is easy to modify and update can help ensure that the automation test suite stays up to date as the underlying systems evolve.

- Emphasize security testing: Using testing approaches that focus on identifying and addressing security vulnerabilities, such as fuzz testing or penetration testing, can help ensure that the automation test suite does not compromise security.

- Use an automation testing tool that is compatible with a wide range of technologies and platforms: Choosing an automation testing tool that integrates with various systems, including legacy systems, can make it easier to automate testing across the entire banking domain.

- Use a test data management tool: A tool that can help to create and manage large amounts of test data securely and efficiently can make it easier to perform testing in the banking domain.

How Enhops can help

It can be a challenging task to test banking applications, but if you work with an experienced testing partner, it is easily accomplished. For addressing all the challenges associated with test Automation, we offer outcome-driven approaches to facilitate the creation of automated tests and their execution. Our testing strategies, along with the right combination of testers and processes, help our banking and financial clients achieve successful and vulnerability-free applications.

We offer a no-strings attached POC model to assist clients in understanding our approach, framework, tools & technologies for test automation. Write to us at info@enhops.com if you are interested in building test automation practice for your BFSI application.