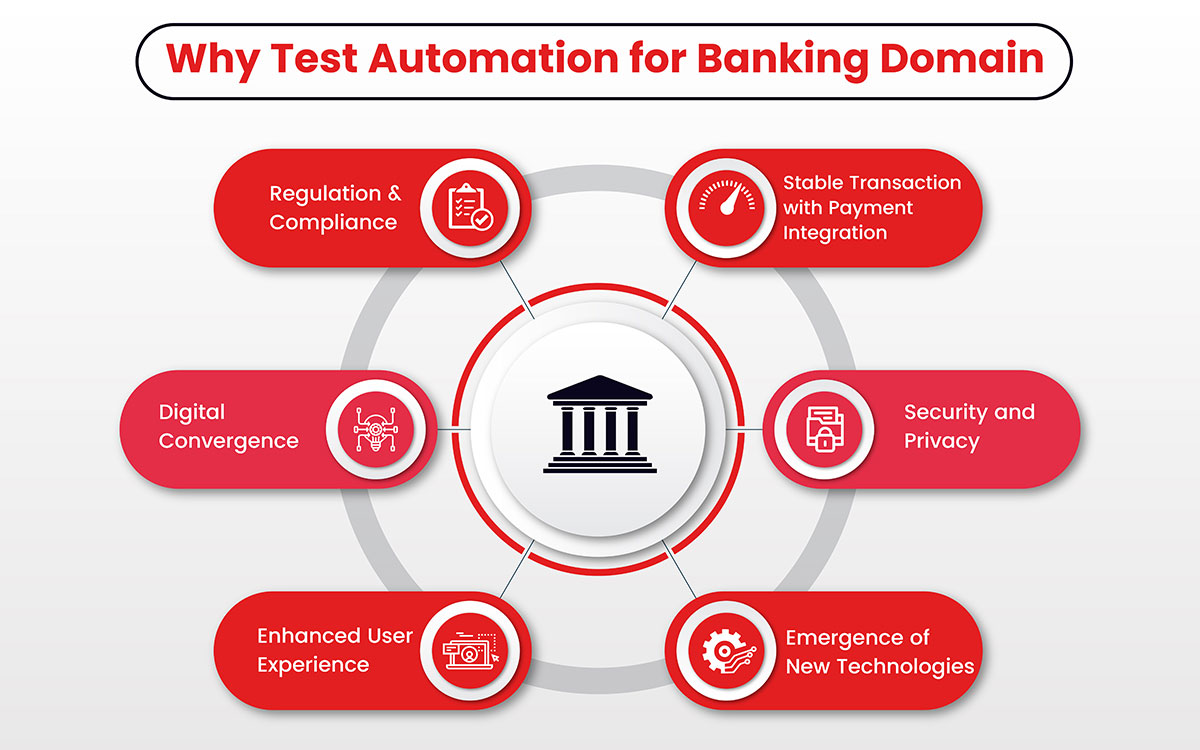

Banking and financial institutions are moving towards AI and Agentic AI rapidly. As a result, financial institutions must provide a high-quality, seamless experience for their digital banking customers. One way to ensure a positive experience is through automation testing in the banking domain.

Test automation refers to automate the testing process of software applications. This includes variety of functional and non-functional testing like unit testing, integration testing, performance testing, and security testing. This helps financial institutions in identifying and fix any issues with their digital banking platforms by automating these tests, improving the overall user experience. Testing applications also involved testing AI and Agentic AI applications to ensure right experience for users.

Modern Banking Services in the Age of AI

Banking systems and applications are continuously evolving. While their core functions such as deposits, loans, foreign exchange, and electronic transfers remain essential, modern applications are becoming increasingly advanced. Key developments include:

In the banking domain, financial institutions offer a range of services, including:

- AI-powered customer service assistants and chatbots

- Personalized financial recommendations using machine learning

- Agentic AI for automating complex tasks like risk analysis and compliance checks

- Predictive analytics for fraud detection and credit scoring

- Voice and facial recognition for secure authentication

- Automated decision-making in loan approvals and investment advice

- AI-powered customer service assistants and chatbots

Banks need to rigorously test their software banking applications to maintain compliance, reliability, and customer trust. With AI-driven test automation, it’s easy for teams to do more of testing with current resources.

Characteristics of a banking domain application

A banking application is a software program that allows individuals and businesses to access their financial accounts and perform various banking transactions, such as checking account balances, transferring money, paying bills, and depositing checks. Several characteristics common to the banking domain:

- Financial transactions: Banking involves the processing of financial transactions, such as deposits, withdrawals, transfers, and payments.

- Regulation: Banks are heavily regulated by government agencies and must comply with strict rules and regulations.

- Risk management: Banks must manage risk in their operations, including credit risk, liquidity risk, and market risk.

- Customer service: Banks must provide good customer service and support, including answering customer questions and addressing their needs and concerns.

- Security: Banks must ensure the security of their systems and protect their customers’ sensitive financial information.

- Innovation: Banks must stay up-to-date with the latest technologies and industry trends to remain competitive.

- Transparency: Banks must be transparent in their operations and disclose information about their products and services to customers.

- Ethics: Banks are expected to operate ethically and in the best interests of their customers.

With recent advancements, all these banking application characteristics have AI element embedded into them.

Is Automated Testing a solution for Banking Domain?

Automation testing can be used to test a wide range of banking-related processes and systems, like online banking systems, AI-driven customer agents and applications, mobile banking apps, and back-end systems for processing transactions and managing customer data. Automation testing can also be used to test the security of banking systems, helping to identify vulnerabilities and ensure that systems are adequately protected against potential threats.

Automation testing can be used to test a wide range of banking-related processes and systems, including online banking systems, mobile banking apps, and back-end systems for processing transactions and managing customer data. Automation testing can also be used to test the security of banking systems, helping to identify vulnerabilities and ensure that systems are adequately protected against potential threats.

There are several benefits of using test automation in the banking domain, including:

- Improved efficiency and speed: Automated testing allow financial institutions to quickly and efficiently test their digital banking platforms, which can save time and resources compared to manual testing. This can help ensure that issues are identified and addressed in a timely manner and early in the software development lifecycle, improving the overall user experience.

- Increased accuracy and consistency: Automated testing can help in ensuring that testing is performed consistently and accurately, as the test scripts are not subject to human error. This can help reduce the risk of issues being missed or misidentified.

- Enhanced security: Automated testing can help financial institutions to identify and address potential security vulnerabilities in their digital banking platforms. This is important as cyber-attacks and data breaches are a major concern for the banking industry.

- Greater coverage: Automation testing can cover a wider range of scenarios and test cases compared to manual testing, helping to identify issues that may not have been uncovered through manual testing alone.

By implementing automated testing in their digital banking platforms, financial institutions can improve the overall user experience, enhance security, and reduce the risk of missed or misidentified issues.

Know more about How to do Automated Testing for BFSI applications

Challenges and solutions of automation testing for banking domain

While test automation can be a useful tool for improving the efficiency and effectiveness of testing in the banking domain, but it also comes with several challenges. Here are some potential challenges and solutions for automated testing in the banking industry:

- Complex business processes: It can be difficult to automate testing for these processes, as it requires a deep understanding of the underlying systems and a robust test design. Work with domain experts to help design the test cases and ensure that they accurately reflect the real-world scenarios being tested. AI-driven testing can help in identifying happy pathways for complex business processes and implement test automation.

- Large and constantly evolving systems: Banking systems are often large and constantly evolving, with new features and functionality being added regularly. Using a customized test automation framework reduces test maintenance efforts. Often, in-house development teams are caught with innovation and other important tasks and regular test cases maintenance are missed out. Banking and financial institutions must consider working with the quality engineering experts who deliver outcome-based results.

- Security concerns: The banking domain involves sensitive financial information and transactions, so it is important to ensure that the automation test suite does not compromise security. Adopt a mix of functional and non-functional testing such as security or penetration testing, to identify and address any potential vulnerabilities.

- Integration with legacy systems: Banking systems have legacy components that are difficult to integrate with new automation testing tools. Create a testing framework that can help in integrating new technologies and platforms.

- Managing test data: Testing in the banking domain often requires the use of large amounts of data, including sensitive financial information. Managing this data can be challenging, as it is important to ensure that the data is secure and that the test cases represent real-world scenarios. AI-driven test data management is creating strides and can help in creating and managing test data securely.

Enhance digital confidence of your banking application with our end-to-end test automation service

Here are some potential solutions for addressing the challenges of automation testing in the banking domain:

- Work with banking domain and quality engineering experts who can help in ensuring that test cases accurately reflect real-world scenarios and cover all relevant business processes and rules.

- Adopt AI-driven testing framework to do more with your existing QA resources.

- Use a flexible and maintainable test automation framework that is easy to modify and update so that the automation test suite stays up to date as the underlying systems evolve.

- Using testing approaches that focus on identifying and addressing security vulnerabilities, such as fuzz testing or penetration testing, can help ensure that the automation test suite does not compromise security.

- Use an automation testing tool that is compatible with a wide range of technologies and platforms ensuring smooth banking software testing.

- Use a test data management tool to create and manage large amounts of test data securely and efficiently can make it easier to perform testing in the banking domain.

AI-Driven Test Automation Framework in 30 days

Enhops offers outcome-driven approaches to address challenges associated with test automation. Our banking software testing strategies, with a mix of traditional and AI-driven automation help our banking and financial clients achieve successful and vulnerability-free applications.

We offer a no-strings attached PoC model to assist clients in understanding our approach, framework, tools & technologies for test automation. Have a BFSI application testing project in mind, let’s talk